Unclaimed Money Act Malaysia Check

Saving part i moneys in court 5.

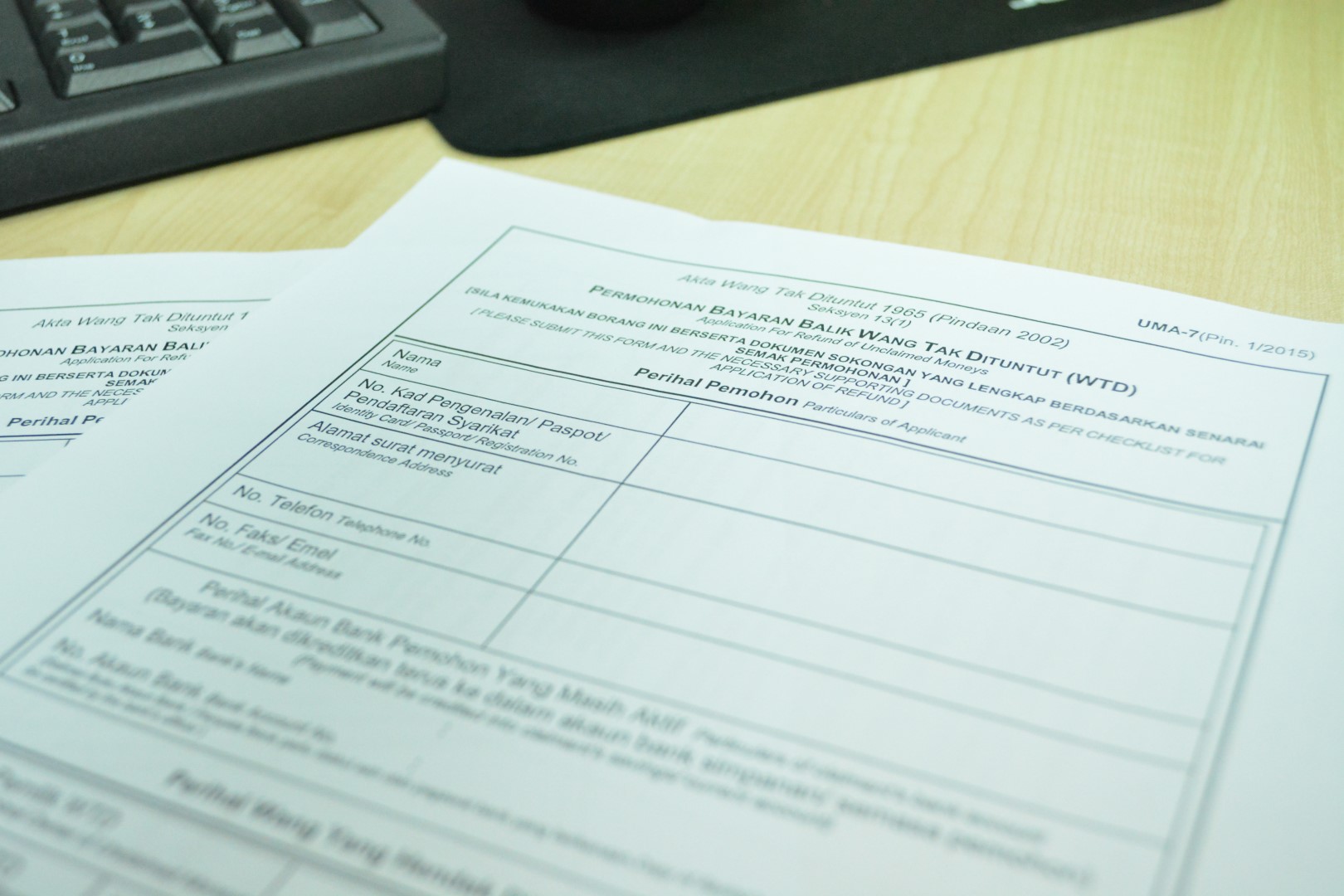

Unclaimed money act malaysia check. The irs will attempt to contact individuals who are entitled to a stimulus check from the cares act but have yet to receive it. Unclaimed moneys 3 laws of malaysia act 370 unclaimed money act 1965 arrangement of sections section 1. Unclaimed money will not have any addition or deduction from the original amount as stated under section 11 3 of act.

9 million unclaimed stimulus checks. This register publishes unclaimed amounts with singapore public sector agencies including ministries organs of state and statutory boards. Follow these steps and you can check whether you have any money held by the government at any time.

The public sector agencies holding on to these monies would very much like to return the monies to the rightful owners but have not always been able to do so because they could not contact the owners despite repeated attempts to do so. Provision for payment into consolidated revenue account in certain cases of unclaimed money in court 6. Before egumis people could only check the status of unclaimed monies by visiting the agd.

Akta wang tak dituntut 1965 such sums of money will be transferred to the registrar of unclaimed moneys. Basically unclaimed monies are made up of inactive bank accounts unclaimed fixed deposits that have expired insurance payouts and other various interests. Back in 2017 the malaysian government talked about launching the electronic government unclaimed money information system egumis designed to make it easier for people to check if they had any unclaimed monies.

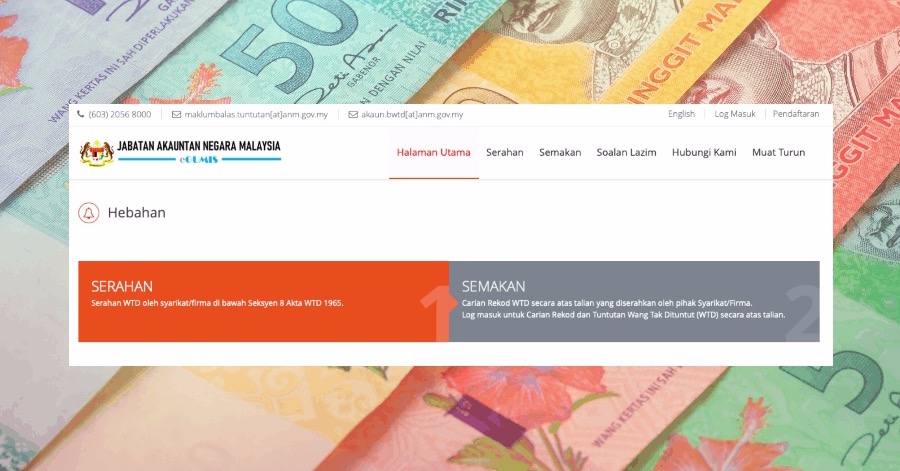

Maintain a record of all unclaimed moneys in a register to be kept at its principal office or place of business in malaysia in the form to be determined by the registrar. According to section 10 unclaimed moneys act 1965 company firm is responsible for the following actions. The accountant general s department of malaysia has launched egumis electronic government unclaimed money information system for the public to check if they have any money that hasn t been claimed yet.

Unclaimed money paid to the public trustee and guardian under the unclaimed money act generally relate to accounts that have been inactive for over six years and can include deposits dividends trust account funds interest refunds overpayments sale proceeds and bonds. Under the unclaimed moneys act 1965 malay. Kuala lumpur jan 9 back in 2017 the malaysian government talked about launching the electronic government unclaimed money information system egumis to make it easier for the rakyat to check if they had any unclaimed monies.

This means owners will not continue to earn interest on unclaimed money. Here s what you need to know. However owners of the fund can check and claim the funds anytime there is no expiry date to claiming the fund.